- HOME

- Sustainability

- Responding to the Task Force on Climate-related Financial Disclosures (TCFD)

Responding to the Task Force on Climate-related Financial Disclosures (TCFD)

Approach and Policies on Climate Change

The Nomura Real Estate Group uses land and other natural resources and energy in the course of conducting business activities and is fully aware that the substantial impact of climate change on our business continuity is a major management issue.

Increased natural disasters resulting from climate change and stricter environmental regulations will impede the continuation of business and lead to higher material procurement costs and construction expenses. It is also possible that operating costs, including electricity fees and insurance premiums, will increase, which could have a major impact on society as a whole. Meanwhile, low-carbon and decarbonized products and services, including net zero energy homes (ZEH), will lead to new business opportunities.

Based on this understanding, the Group is working with stakeholders to promote the reduction of CO₂ emissions and the use of renewable energy across its supply chains.

Understanding Climate Change

Climate change is currently recognized as one of the most significant threats to the sustainable development of global society. The Fifth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC), released over the course of 2013 and 2014, states that human activities are “extremely likely” (at least 95%) to be the main cause of global warming and climate change. Subsequently, the IPCC Sixth Assessment Report, released in August 2021, states that it is “unequivocal” that human activities are the main cause of global warming and climate change.

Based on these scientific views, a debate on how to deal with climate change has raged in society as a whole and across the world. At the Conference of the Parties (COP21) of the United Nations Framework Convention on Climate Change (UNFCCC) in 2015, the Paris Agreement was adopted to pursue efforts to “limit global warming to well below 2, preferably to 1.5°C, compared to pre-industrial levels.”

Under the Paris Agreement, countries have set targets for reducing Greenhouse Gas (GHG) emissions and are implementing a variety of climate change-related measures. For example, in Japan, where our Group mainly operates, the government declared its goal in October 2020 to achieve carbon neutrality by 2050.

The impact of climate change on the global economy and corporate activities is becoming increasingly severe with each passing year. Accordingly, shareholders and investors are facing a growing urgency to assess how the businesses and plans of each company will be affected by climate change. Recognizing the need for a common global framework that facilitates an appropriate assessment of the risks and opportunities of climate change for each company, the TCFD was established to promote disclosure of information on climate change responses in response to requests from the G20 and national central banks. It released its final report in June 2017 and has been encouraging companies to disclose information on climate change.

Given this environment, we recognize that addressing social and environmental issues is essential for the sustainable growth of our company. We clearly stated “urban development and community building concerning the future of the global environment and local communities” as one of the four value creation themes for our Mid- to Long-term Business Plan, released in April 2019.

Mid- to Long-term Business Plan

In carrying out sustainability activities, the Group considers the environment and climate change as vital management concerns. We have also defined the four key themes of “Safety and Security,” “the Environment,” “Community,” and “Health and Well-being” as of March 31, 2022, and positioned responding to climate change as a key area under “Environment.”

Governance

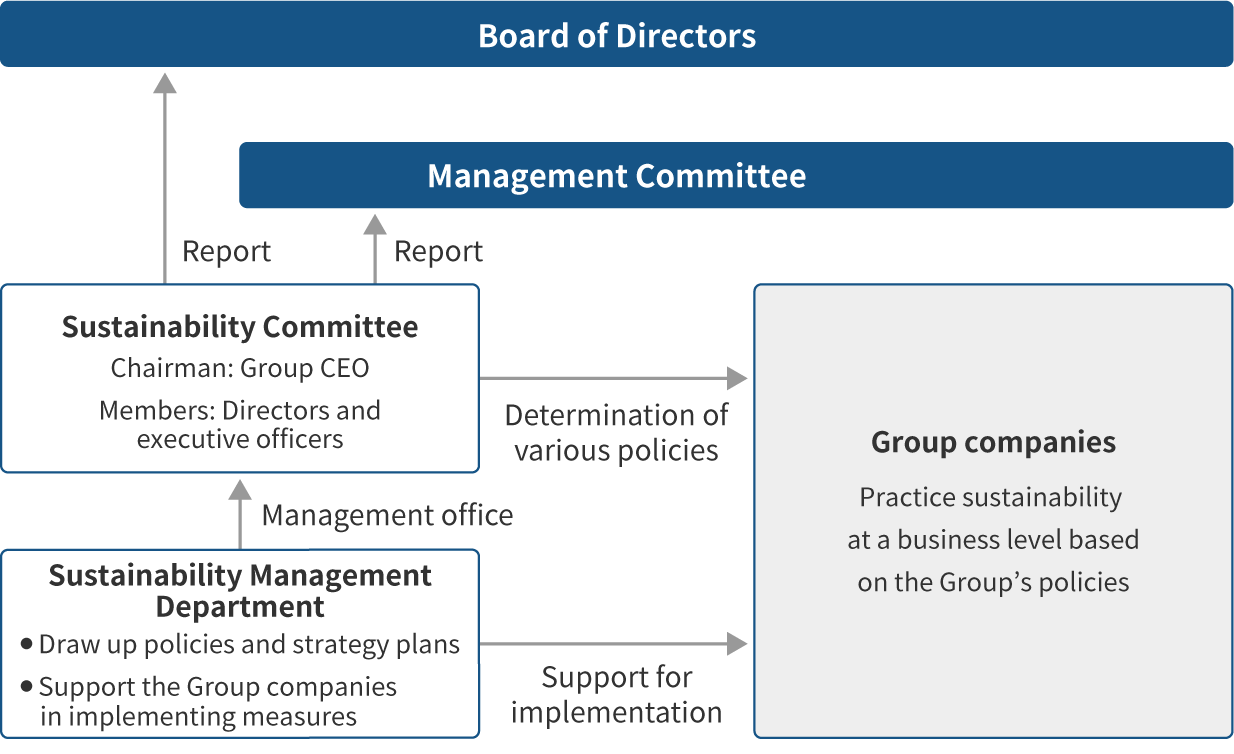

The Sustainability Committee, which comprises Nomura Real Estate Holdings and Group company directors and others, and is chaired by the Nomura Real Estate Holdings President and Group CEO, deliberates Group-wide policies and targets related to climate change. The committee is positioned as a subordinate committee of the Management Committee and holds at least three to four meetings each year. It reviews risks and opportunities associated with climate change and examines and monitors the Group’s GHG reduction targets. Details of deliberations made by the committee are reported to the Board of Directors and the Management Committee at least twice a year. In addition, any key matters related to the Group’s management are reported to the Board of Directors and Management Committee as necessary.

As mentioned above, the Nomura Real Estate Holdings President and Group CEO is responsible for promoting measures to address sustainability and climate change throughout the Group. The Group CEO is the chief executive officer of the Board of Directors and the Executive Committee and is responsible for making the best decisions to achieve the sustainable growth of the Group as a company, including addressing sustainability and climate change, and for executing key related operations.

In addition, our risk management system also manages climate change-related risks.

| Risk Category | Definition | |

|---|---|---|

| (A) | Investment risk | Risk related to individual investments (real estate investment, strategic investment (M&A), etc.) |

| (B) | External risk | Risks related to external factors influencing business |

| (C) | Disaster risk | Risks generated by disasters that have a large impact on customers and business continuity |

| (D) | Internal risk | Operational risks occurring at the company and each Group company |

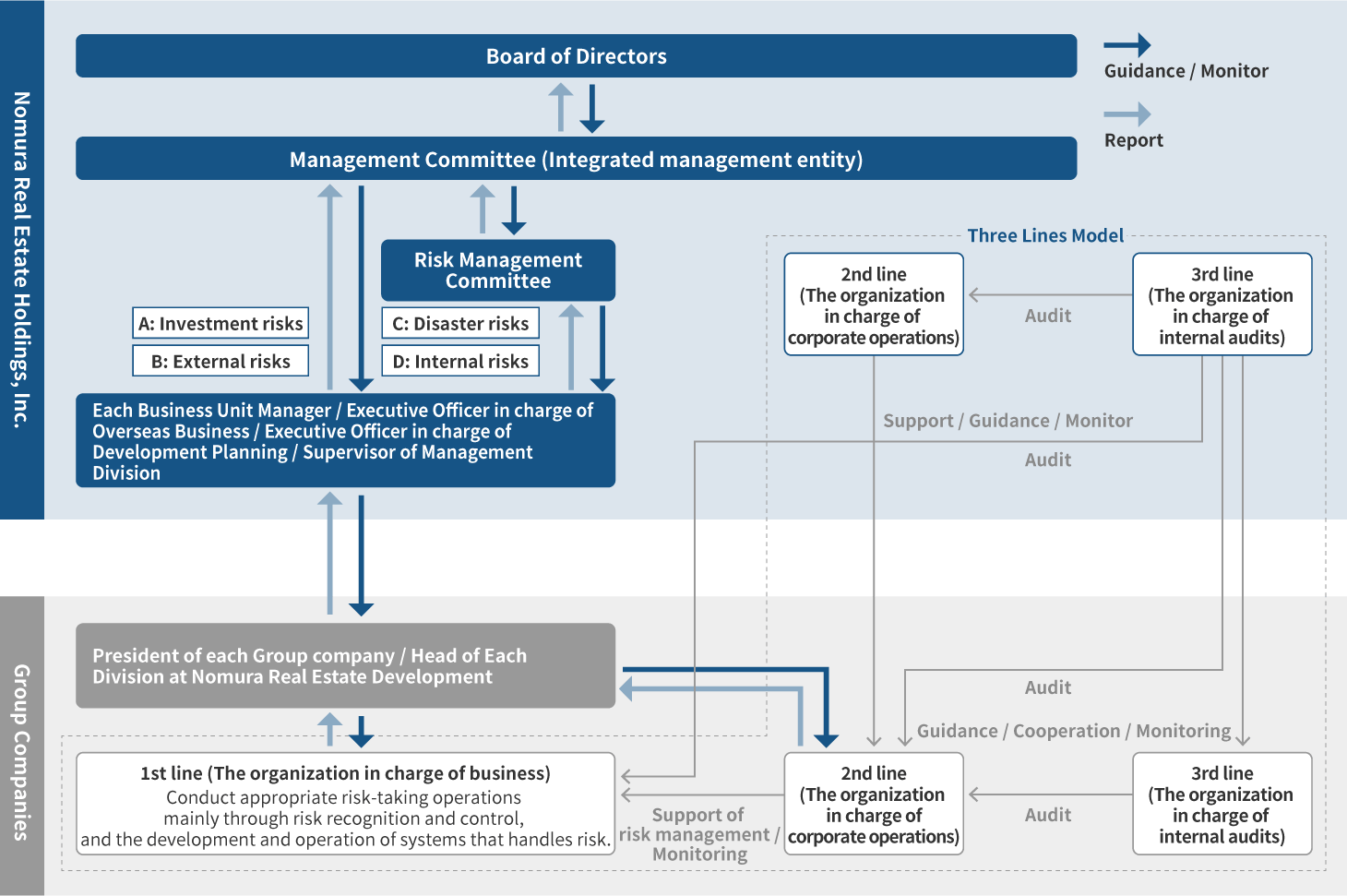

To discuss various risks related to group management, the Company has prescribed the Management Committee as the integrated risk management body and operates a system to regularly monitor, evaluate and analyze the state of main risks, provide necessary guidance and advice to each business unit and Group company while regularly reporting details to the Board of Directors. The Management Committee, which is the integrated management body, directly monitors A: Investment risk and B: External risk, while the Risk Management Committee, established as a subordinate organization of the Management Committee, conducts regular monitoring, evaluation and analysis of C: Disaster risk and D: Internal risk and discusses basic response policies regarding risk prevention, responses when risk occurs, and prevention of recurrence. Risks related to climate change are positioned under the following categories managed as part of our business risks: risk from lagging behind innovation and changes in the social structure related to the business (risk category B: external risk) and risk caused by disasters (earthquakes, typhoons, floods, tsunamis, volcanic eruptions, major fires, epidemics of infectious diseases, etc.) that have a major impact on customers and business continuity (risk category C: disaster risk).

Each business unit closely monitors social trends related to climate change, such as changes in customers and markets and revised regulations. They also identify risks and opportunities in climate-related issues and examine and implement associated actions at the operational, business, and product levels. One example is the planning of Net Zero Energy House (ZEH) and Net Zero Energy Building (ZEB) based on changes in the market and customer needs, technology trends, and other factors. Of these initiatives undertaken by each business unit, those deemed particularly important to management are reported to the Sustainability Committee, Risk Management Committee, Management Committee, and Board of Directors as needed.

In addition, since fiscal 2019, the Group has been requiring. that directors, including the CEO, maintain a strong awareness of the need to adapt to changes in society and the needs of the times under their selection criteria, and has also incorporated the sustainability and ESG perspectives, such as climate change, into decisions on director compensation. In our director compensation system, the degree of achievement of sustainability targets, including measures to respond to climate change, in the business areas under the control of each director is incorporated into evaluation criteria. Also, the system calculates variable compensation according to the degree of achievement of roles related to sustainability and ESG assigned to each director.

Strategies

In formulating climate change strategies, the Group conducted a qualitative analysis using scenarios based on the Fifth Assessment Report of the IPCC* and the Paris Agreement. We examined the risks and opportunities that climate change may present to the Group, and then we planned and implemented strategies and measures to manage them.

The Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC) released in August 2021 will also be used for analysis for future fiscal years.

Scope of Analysis

The Group consists of the Residential Development Business Unit (development and sales of condominiums and detached houses), Commercial Real Estate Business Unit (development, leasing, and sales of office buildings, commercial facilities, logistics facilities, and hotels), Investment Management Business Unit (management of REIT and private funds), Brokerage and CRE Unit (real estate brokerage), Operations and Management Unit (real estate management), and others (overseas), which are all included in the scope of analysis.

As for the calculation scope of GHG emissions, all of scopes 1, 2, and 3 of the Group are covered.

Scenario Setting

The scenario analysis adopted the 2°C scenario with an eye to achieving the goals of the Paris Agreement and realizing a decarbonized society. In this analysis, we also consider the 4°C scenario as a situation in which climate change measures fail to make sufficient progress and natural disasters consequently become more severe. In developing the world image for each scenario, we referred to the following documents. We are also separately working on the 1.5°C scenario.

- ・Representative Concentration Pathway (RCP) 2.6 and 8.5 scenarios in the UN IPCC Fifth Assessment Report

- ・Sustainable Development Scenario (SDS) and Stated Policies Scenario (STEPS) in the IEA World Energy Outlook (2020)

Possible changes to the global environment under each scenario

Under each scenario, we have established an image of the world in 2050 for the 2°C and 4°C scenarios. (The 1.5°C scenario is also examined separately.)

| Items | 2°C scenario | 4°C scenario |

|---|---|---|

| Sea level rise | 0.3–0.5 m

|

0.4–0.8 m

|

| Typhoon | Increase (Japan)

|

Significant increase (Japan)

|

| Flood | Increase (Japan: about two times as much)

|

Significant increase (Japan: about four times as much)

|

| Midsummer days | Increase (Japan: by about 10 days)

|

Significant increase (Japan: by about 50 days)

|

| Laws and regulations | Progress in enforcing extremely strict regulations

|

Limited regulatory impact

|

| Technology | Progress in the adoption of decarbonization technologies, ZEH and ZEB, and renewable energies

|

No progress in the adoption of decarbonization technologies, ZEH and ZEB, and renewable energies

|

| Customers | About 50% reduction in energy consumption in offices where the adoption of ZEH, ZEB, and renewable energies is progressing

|

Limited adoption of ZEH, ZEB, renewable energies, etc. About 20% reduction in energy consumption in offices |

Identification of Risks (and Opportunities)

The TCFD recommendations classify climate change risks into transition risks (policy and legal, technology, market, and reputation) and physical risks (acute and chronic). The Group has accordingly identified the impacts of these risks on the Group. This section describes the representative impacts of each risk category.

| Category | Impact on the Group | Our understanding | |

|---|---|---|---|

| Large | Small | ||

| Transition risks | Policy and legal

|

Enforcement and strengthening of GHG reduction regulations on a business and property basis (Scopes 1 and 2)Potential consequences

|

Risks Opportunities |

| Market

|

Delay in the improvement of energy efficiency of buildings (buildings, houses, etc.) and the development and introduction of decarbonization technologiesPotential consequences

|

Risks Opportunities |

|

| Reputation

|

Increased demand from customers for functions related to the environment, energy conservation, and disaster preventionPotential consequences

|

Risks Opportunities |

|

| Technology

|

Risk of the Group’s initiatives and businesses not being well received by investors and consumers.Potential consequences

|

Risks Opportunities |

|

| Physical risks | Acute

|

Losses due to the occurrence of disasters, such as typhoons, floods, and torrential rainsPotential consequences

|

Risks |

| Chronic

|

Impact on businesses due to rising average temperatures Impact on real estate appraisal due to rising sea level Potential consequences

|

Risks | |

Risk Management

Matters related to climate change, including risk management, are overseen by the Board of Directors and the Management Committee and are discussed in detail by the subordinate committees, the Sustainability Committee, and the Risk Management Committee. In addition, individual business matters, including business planning and product planning, are managed by each business unit.

The Sustainability Committee deliberates Group-wide policies and targets on climate change and discusses the risks and opportunities of climate change for the entire Group.

In addition, risks related to climate change are also managed within the risk management system of the Group. To discuss various risks related to Group management, we have designated the Management Committee as the integrated risk management body and operate a system to regularly monitor, evaluate, and analyze the state of major risks while periodically reporting details to the Board of Directors.

Business units also individually investigate and grasp risks related to the market (client companies and consumers) and laws and regulations on construction and real estate, and they reflect the results of their investigations in the planning of businesses and products as needed. Of the matters examined, those that have a significant impact on the Group as a whole are reported to the Board of Directors, Management Committee, Sustainability Committee, and Risk Management Committee as appropriate, depending on specific content.

Metrics and Targets

The Group has set the following three targets to promote its response to climate change and has also identified the indicators described below for greenhouse gases.

-

Reduction of Greenhouse Gases (GHG and CO₂)

Medium- to Long-term Targets* ※Certified by the SBT (Science Based Targets) Initiative in November 2020

Reduce the total amount of GHG emissions from Scopes 1, 2, and 3 (Categories 1 and 11)* by 35% by 2030 compared to the FY2019 level.Short-term Target

Reduce the total amount of emissions from Scopes 1, 2, and 3* (Categories 1 and 11) by 15% by 2025 compared to the fiscal 2019 level.Scope 1: Direct emissions such as fuel combustion, Scope 2: Indirect emissions resulting from the use of electricity or heat purchased by the Company, Scope 3: Indirect emissions other than those in Scopes 1 and 2

Scope 3 targets cover Categories 1 (products and services purchased) and 11 (use of products sold). The GHG emissions of Category 1 cover approximately 94% of the total emissions of Scope 3. (FY2019)

Mid-to long-term target

The power consumption of Scope 1 and 2 in the Group will be 100% renewable electricity by 2050.(joined RE100 in January 2022)Short-term target

Switching electricity consumed by all leasing properties* owned by Nomura Real Estate Development to renewable electricity by 2023.Excludes leasing properties (including the portion used by tenants) for which Nomura Real Estate Development has concluded direct electricity supply contracts with power companies, properties that Nomura Real Estate Development owns units in or are jointly owned with other parties, and properties planned to be sold or demolished, as well as the common use areas of some rental housing.

-

Reduce Energy Use

The Group will in principle promote measures to respond to climate change by collecting data on GHG (CO₂) emissions for all properties owned and sold by the Group as a whole and reducing the GHG emissions of the entire Group by compiling and monitoring the results. We will also look into setting an ultra-long-term target to achieve carbon neutrality by 2050. For the results related to climate change, please refer to the following.

Results for Medium- to Long-term Targets (2030 Targets)

| FY2019 (base year) | FY2020 | ||

|---|---|---|---|

| Reduction rate (compared to FY2019) | |||

| Scope1 | 23,627 | 20,119 | - 14.8% |

| Scope2 | 126,960 | 112,087 | - 11.7% |

| Scopes 1 and 2 total | 150,588 | 132,206 | - 12.2% |

| 1: Purchased products and services | 969,704 | 453,707 | - 53.2% |

| 11: Use of products sold | 2,203,005 | 834,184 | - 62.1% |

| Scope 3 total Note: Targeted only |

3,172,709 | 1,287,891 | -59.4% |

Third Party Assurance

We have asked Lloyd’s Register Quality Assurance Ltd. to provide assurance on the GHG emissions and energy use data for the entire Group.

Reference: Performance on Other Climate Change-Related Issues

(1) GHG emissions performance in Scopes 1 and 2

| FY2018 | FY2019 (base year) |

FY2020 | |

|---|---|---|---|

| Scope1 | 24,018 | 23,627 | 20,119 |

| Scope2 | 136,569 | 126,960 | 112,087 |

| Scopes 1 and 2 (total) | 160,586 | 150,588 | 132,206 |

(2) GHG emissions performance by all items in Scope 3

| FY2019 (base year) |

FY2020 | ||

|---|---|---|---|

| Reduction rate (compared to FY2019) | |||

| 1: Products and services purchased | 969,704 | 453,707 | - 53.2% |

| 2: Capital goods | 71,164 | 97,862 | + 37.5% |

| 3: Fuel- and energy-related activities that are not included in Scopes 1 and 2 | 27,473 | 24,854 | - 9.5% |

| 4: Transportation and delivery (upstream) | 4,081 | 3,164 | - 22.4% |

| 5: Waste generated by businesses | 6,858 | 5,317 | - 22.4% |

| 6: Business trips | 1,421 | 936 | - 34.1% |

| 7: Employers’ commuting | 2,395 | 2,409 | + 0.5% |

| 8: Lease assets (upstream) | ― | ― | ― |

| 9: Transportation and delivery (downstream) | ― | ― | ― |

| 10: Processing of products sold | ― | ― | ― |

| 11: Use of products sold | 2,203,005 | 834,184 | - 62.1% |

| 12: Disposal of products sold | 62,603 | 19,605 | - 68.6% |

| 13: Lease assets (downstream) | 19,011 | 14,025 | - 26.2% |

| 14: Franchise | ― | ― | ― |

| 15: Investments | ― | ― | ― |

| Scope 3 total | 3,367,714 | 1,456,063 | - 56.7% |

(3) Energy use performance in properties subject to reporting under the Act on the Rational Use of Energy

| FY2018 | FY2019 | FY2020 | |

|---|---|---|---|

| Energy use (MWh/year) | 445,772 | 422,490 | 381,817 |

| Energy use intensity* (MWh/m²/year) | 0.224 | 0.208 | 0.184 |

For the calculation of the energy use intensity, the energy use is divided by the gross floor area of a property subject to reporting under the Act on the Rational Use of Energy (property subject to reporting on energy saving).

(4) Implementation of the solar power generation business

The Group is promoting the Solar Power Generation Business. As of the end of March 2021, solar panels were installed on a total of 18 buildings at Landport logistics facilities, with annual output of 21.926 thousand kWh/year for fiscal 2020.

| FY2018 | FY2019 | FY2020 | |

|---|---|---|---|

| Solar power generating facility installation rate at Landport logistics facilities (%) | 92.9% | 94.7% | 90.0% |

| Electric power generated at Landport logistics facilities (thousand kWh/year) | 12,081 | 15,194 | 21,926 |

(5) Use of renewable energy

All of the electricity procured for all Noga Hotels operated by Nomura Real Estate Hotels, one of the Group’s businesses, Garden Hotels operated by UHM, a Group company, and MEFULL, a commercial facility specializing in services developed by Nomura Real Estate Development (3.47 GWh in FY2020) is practically 100% renewable under the Zero CO2 Plan provided by NF Power Service, a retail electricity provider and affiliate of the Group. In fiscal 2020, a total of 3,732,000 kWh of renewable energy was procured. In addition, we purchase one million kWh of green electricity per year for the Nihonbashi Muromachi Nomura Building.

(6) ZHE initiatives

The Group is developing net zero energy homes (ZEH)* in condominiums from the perspective of comprehensive environment impact reduction.

In fiscal 2020, the PROUD Tower Kameido Cross Gate Tower was adopted as a Ministry of Economy, Trade and Industry Superhigh-rise ZEH-M Demonstration Project, and the Kagurazaka Fukuromachi Plan (tentative name) and Musashiurawa Station Plan (tentative name) were adopted as a Ministry of the Environment High-rise ZEH-M Support Project.

ZEH (Net Zero Energy House)

Homes designed to achieve a net zero annual primary energy consumption by greatly improving the insulation performance of the building envelope, installing highly efficient facilities and equipment to maintain the quality of the indoor environment, while substantially reducing energy consumption and then introducing renewable energy.

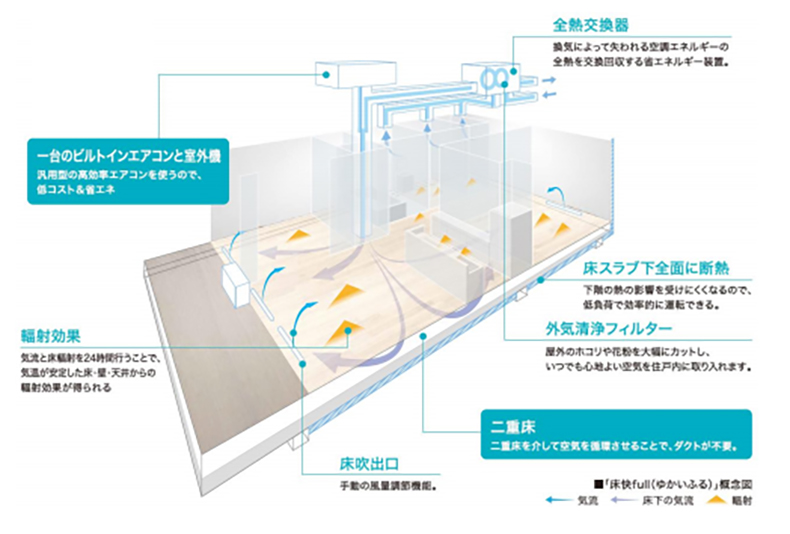

“Yukai full” Offering Both Environmental Performance and Healthy, Comfortable Living

In order to deliver the energy-saving performance of ZEH-M, we have adopted “Yukai full” in PROUD Takadanobaba and PROUD Tower Kameido Cross. The “floor full” system uses the double floor as a pathway for heating, cooling, and ventilation, sending air conditioner breezes and fresh outside air throughout the entire dwelling, keeping the entire dwelling comfortable 24 hours a day, 365 days a year. This contributes to maintaining the overall health of the residents by reducing the risk of heat stress and heatstroke. In addition, the system can be operated at a lower temperature setting than usual when residents are out of the house, thereby saving energy while maintaining comfort and improving energy efficiency.

(7) Initiatives for the Shibaura 1-chome Project

The Shibaura 1-chome Project is a phased reconstruction project of a large-scale complex of offices, commercial facilities, hotels, and other facilities in Minato-ku, Tokyo, and it has been approved as a national strategic special zone.

Under the theme of creating a city for healthy and comfortable living, the project aims to realize both the ideal state of the next generation of tenant buildings and CO₂ reduction by realizing a Wellness Office, achieving ZEB Oriented through various energy-saving measures and ultimately becoming carbon neutral by introducing electricity derived from renewable energy sources in the future. In recognition of this plan, the project was selected by the Ministry of Land, Infrastructure, Transport and Tourism for the leading projects program for sustainable buildings (CO₂ reduction type) in 2021.

(8) Other individual initiatives

(8-1) Initiatives for obtaining green building certifications

The Group seeks to obtain environmental, green building certifications for new construction and owned properties including DBJ Green Building*1, LEED*2, CASBEE*3, and BELS*4.

Quantified target: acquisition rate of green building certifications for newly constructed fixed assets and income-producing properties (excluding rental housing): 100%

DBJ Green Building

A certification program developed by the Development Bank of Japan to promote real estate development that contributes to the environment and society.

LEED

A system developed and operated by the U.S. Green Building Council for granting certification to environmentally conscious buildings.

CASBEE

Comprehensive Assessment System for Built Environment Efficiency, includes the certification program administered by the Institute for Building Environment and Energy Conservation (IBEC) and independent local municipality assessment programs.

BELS

Building-Housing Energy-efficiency Labeling System, established by the Ministry of Land, Infrastructure, Transport and Tourism. With this system, a third-party evaluation organization evaluates and certifies energy conservation performance of a building.

(8-2) Environmental performance assessment during product planning and design

The Group provides products and services that address climate change in accordance with the Design and Construction Standards and the Quality Manual. Thermal insulation performance rating* of level 4 (the highest level), double-glazed windows (end panel eco-glass), LED lighting fixtures, and other features are set as standard specifications for PROUD condominiums, and Environmental Assessment and Challenge Sheets are used to improve the environmental performance.

A housing performance evaluation system pursuant to the Housing Quality Assurance Act. Levels indicate performance in the thermal environment.

(8-3) Helping customers to save energy

The Group not only strives to reduce CO₂ emissions from buildings; it also helps condominium residents and tenant companies to save energy. Specifically, the Group provides a system that calculates total energy consumption and a system that makes it possible to visualize the amount of energy used, realizes energy savings using the enecoQ system, and provides eco-information via a member newsletter.

(8-4) Reduction of chlorofluorocarbons

To reduce the usage of ozone layer-depleting chlorofluorocarbons, the Group established a quality manual that requires the use of chlorofluorocarbon-free insulation and air conditioner refrigerants. Construction partners are also required to submit a Quality Control Check Sheet during construction to confirm that only chlorofluorocarbon-free materials are used.

(8-5) Sustainable finance initiatives

In response to the needs of investors, financial institutions, and other stakeholders, we implement sustainable finance initiatives to promote initiatives related to sustainability and climate change throughout the Group.

-

Implementation of Sustainability Linked Loans (July 2021)

With the support of The Chiba Bank, Ltd., Nomura Real Estate Holdings established the Comprehensive SLL Framework for sustainability linked loans (SLL). On July 30, 2021, Nomura Real Estate Holdings raised funds from nine banks participating in the TSUBASA Alliance, a broad regional bank alliance, as the first procurement based on this framework. The SLL requires coordination and agreement on individual requirements, such as Sustainability Performance Targets (SPTs). This framework provides a preferential interest rate based on the SBT certified mid- to long-term targets for 2030 (35% reduction in total GHG emissions in FY2030 compared to FY2019) set as SPTs, and if they are met by 2030.

To ensure the credibility of this framework, we have obtained a third-party evaluation from Rating and Investment Information, Inc. on compliance with the Sustainability Linked Loan Principles and the rationality of the SPTs set. -

Issuance of Sustainability Bonds (February 2021)

In February 2021, Nomura Real Estate Holdings issued ten billion yen of Sustainability Bonds as a means of procuring funds to be used for measures and projects that contribute to addressing both environmental and social issues.

When issuing the bonds, we formulated the Nomura Real Estate Group Sustainability Bond Framework and allocated the funds raised under the framework to eligible projects that contribute to addressing environmental and social issues.

To ensure the credibility of the framework, we have obtained third party evaluations from Vigeo Eiris, Japan Credit Rating Agency, Ltd. (JCR), and Rating and Investment Information, Inc. (R&I) on the compliance with the principles of the International Capital market Association (ICMA) Sustainability Bond Guidelines, etc.News Release 1 (Japanese only) News Release 2 (Japanese only)

Sustainability

- The Nomura Real Estate Group’s Stance on Sustainability

- Climate Change and the Natural Environment

- Society and Employees

- ESG Data